Authors > Robert Presser

Robert Presser

The Music has Stopped – Why Are We Still Dancing?

By Robert Presser on July 18, 2012

Partygoers are familiar with the ritual at the end of a festive evening – the band announces the last song, those still up for a dance take to the floor, other revellers observe, have a last drink or finish up their conversations. When the music’s over, the band thanks everyone for coming out, the lights go up and then the staffers encourage everyone to head to the door. At least this is how it is supposed to be.

Partygoers are familiar with the ritual at the end of a festive evening – the band announces the last song, those still up for a dance take to the floor, other revellers observe, have a last drink or finish up their conversations. When the music’s over, the band thanks everyone for coming out, the lights go up and then the staffers encourage everyone to head to the door. At least this is how it is supposed to be.

This is not the case if the party is being thrown by the debt-laden developed economies of the world, and especially those within the European Economic Community who are members of the Eurozone.

Gems from the 2012 Budget

By Robert Presser on May 18, 2012

So far, Canadians are an easy lot to distract. The big budget lead item was the gradual increase in the age of eligibility for Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) from 65 to 67 by 2023. The provinces accused the federal government of downloading since their governments will step in to support those seniors who cannot afford to lose the extra two years of federal payments. Ageing baby-boomers were upset by the change, since most had taken retirement support at 65 as an unchangeable right regardless of the fiscal ability of the government to support it.

So far, Canadians are an easy lot to distract. The big budget lead item was the gradual increase in the age of eligibility for Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) from 65 to 67 by 2023. The provinces accused the federal government of downloading since their governments will step in to support those seniors who cannot afford to lose the extra two years of federal payments. Ageing baby-boomers were upset by the change, since most had taken retirement support at 65 as an unchangeable right regardless of the fiscal ability of the government to support it.

Deutschland Uber Alles?

By Robert Presser on March 12, 2012

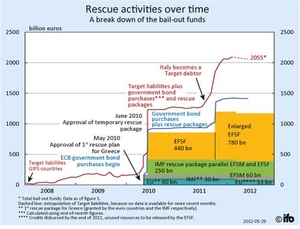

Decades ago, Konrad Adenauer spoke of Germany’s postwar place in Europe when he said, “A European Germany, not a German Europe.” Since Adenauer uttered those words, Germany, together with France have been at the core of all the great initiatives to create greater European integration and cooperation – the formation of the EU, the opening up to former Eastern Bloc nations, and the adoption of the Euro. Now that the EU is in crisis over debt, deficits and currency devaluation, Germany has chosen to assert greater leadership in its own interests, effectively vetoing repeated calls to have theEuropean Central Bank act as a bank of last resort and buy up Greek, Italian and Spanish debt (as a start).

Decades ago, Konrad Adenauer spoke of Germany’s postwar place in Europe when he said, “A European Germany, not a German Europe.” Since Adenauer uttered those words, Germany, together with France have been at the core of all the great initiatives to create greater European integration and cooperation – the formation of the EU, the opening up to former Eastern Bloc nations, and the adoption of the Euro. Now that the EU is in crisis over debt, deficits and currency devaluation, Germany has chosen to assert greater leadership in its own interests, effectively vetoing repeated calls to have theEuropean Central Bank act as a bank of last resort and buy up Greek, Italian and Spanish debt (as a start).

Angie and Sarko save the Euro!

By Robert Presser on December 16, 2011

The following conversation was overheard at the weekly emergency meeting of the European First Ministers prior to the G20 meeting in Cannes. German Chancellor Angela Merkel and French President Nicolas Sarkozy were reviewing the final communiqué before meeting the press. Sarkozy (NS) and Merkel (AM) are grappling with the challenge of coming up with a solution to the Euro debt crisis once and for all, since previous proposals failed to calm international markets...

It's all Greek to Me: Linking the delusions of the Occupy Movement and the EU protestors

By Robert Presser on December 16, 2011

As the Occupy movement clashes with municipal governments across North America and protests continue against austerity in Europe, governments, the broader public and the media continue to debate as to what these protesters really want. The Occupiers and European protestors decry the “inequality” and “injustice” of the current western economic model that has bred “excesses” thatfavoured the top one percent of taxpayers. However, most of the other 99% have not embraced the movement-why not? Perhaps an investigation of these terms will help us figure out why.

As the Occupy movement clashes with municipal governments across North America and protests continue against austerity in Europe, governments, the broader public and the media continue to debate as to what these protesters really want. The Occupiers and European protestors decry the “inequality” and “injustice” of the current western economic model that has bred “excesses” thatfavoured the top one percent of taxpayers. However, most of the other 99% have not embraced the movement-why not? Perhaps an investigation of these terms will help us figure out why.

The lingering costs of 9/11

By Robert Presser on October 26, 2011

Looking back on the economic aftermath of the terrorist attacks on the World Trade Center is a difficult process because so much of it involves speculation as to what might have been. How would the US have spent, or better yet, not spent, the one to two trillion dollars required to fund the wars in Afghanistan and Iraq? How much growth has been denied to the developing world because of curtailed investment out of the fear of continued attacks on first world assets abroad? What opportunities have been missed because of travel avoidance in our personal and professional lives? All of these hypothetical and theoretical alternative economic scenarios are challenging to quantify but are worth considering if we are to chart an economic course through what looks to become a decades-long war against international terrorism.

Teetering on the edge of the unknown

By Robert Presser on August 26, 2011

As I write this article I cannot say with any degree of optimism that any of these struggles will produce a positive outcome. The unprecedented, multi-dimensional (military, social and economic) tumult we are currently experiencing is unprecedented in modern history outside of a major world war. Our collective ability to muddle through thus far is testament to the efficacy of modern international cooperation among developed and developing nations. Those who believe that our institutions like the United Nations, the International Monetary Fund, the World Bank, the European Bank, the G20 and others are compromised and ineffectual should pause and consider what would have happened since 2008 had these institutions not provided a forum for discussion and coordinated response.

As I write this article I cannot say with any degree of optimism that any of these struggles will produce a positive outcome. The unprecedented, multi-dimensional (military, social and economic) tumult we are currently experiencing is unprecedented in modern history outside of a major world war. Our collective ability to muddle through thus far is testament to the efficacy of modern international cooperation among developed and developing nations. Those who believe that our institutions like the United Nations, the International Monetary Fund, the World Bank, the European Bank, the G20 and others are compromised and ineffectual should pause and consider what would have happened since 2008 had these institutions not provided a forum for discussion and coordinated response.

Majority economics in a polarized house

By Robert Presser on June 10, 2011

Stephen Harper already led the longest-serving minority government in Canadian history before his majority win on May 2nd. After five years of centrist economic management as a necessity for passing budgets as a minority government, Harper now has an opportunity to put his and the Conservative Party’s stamp on the Canadian economy for the coming decade. The question now becomes whether the government will continue to pursue centrist, incremental policies or if it will embrace several big, bold, transformational ideas to leave a lasting effect on the Canadian economy.

Creative Destruction in Japan

By Robert Presser on April 21, 2011

Some may recall the teachings of Joseph Schumpeter, the Austrian economist (1883-1950) who advocated the concept of creative destruction. Schumpeter argued that old economic models or investments had to be destroyed in order to liberate the financial and human capital to undertake new, innovative and more profitable ventures. For the first time since the end of WWII, a major developed economy has suffered an economic calamity of the scale deserving an analysis under Schumpeter’s model. The question is whether Japan, as an economic and social society, is prepared to seize this moment to radically change its economic model, or if it will miss the moment and re-create what has not served it well over the past 20 years.

Paying for Democracy

By Robert Presser on April 21, 2011

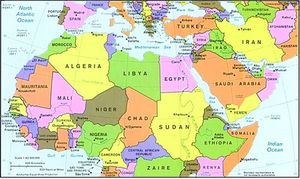

The revolutions taking place across Arabian North Africa are astounding for the rapidity with which they overthrew longstanding dictatorships and the confusion they provoked in Western governments. The US, UK, France and Germany had to decide when and how they would abandon the leaders they had backed for decades, and in the case of Libya the first coalition of the willing since the 1991 Gulf war was created to pound Gaddafi’s forces into retreat to allow the rebels to retain Benghazi.

The revolutions taking place across Arabian North Africa are astounding for the rapidity with which they overthrew longstanding dictatorships and the confusion they provoked in Western governments. The US, UK, France and Germany had to decide when and how they would abandon the leaders they had backed for decades, and in the case of Libya the first coalition of the willing since the 1991 Gulf war was created to pound Gaddafi’s forces into retreat to allow the rebels to retain Benghazi.

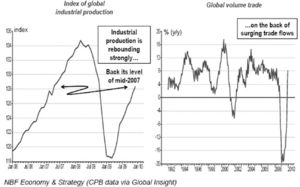

The Flashlight at the End of the Tunnel Can we cement a fragile recovery in 2011?

By Robert Presser on February 16, 2011

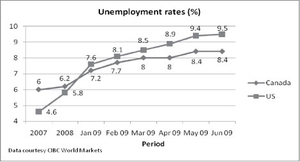

Statistics often mask a reality that is more complex than the numbers. The US has been in recovery for over a year, yet most Americans will tell you that it feels as if it has not even started. In Canada, our recession was the mildest of all the industrialized nations yet our mindset is still influenced by the slow recovery of our southern neighbour. Economists in both countries have said that employment growth is the key to sustaining the recovery; consumer confidence and, eventually, consumer spending must be strengthened via income growth overall.

Guns and money running for the exits: Timidity and introspection characterize the latest G20 and NATO summits

By Robert Presser on December 27, 2010

Two important international meetings took place in November – the G20 met in Seoul and NATO met in Lisbon. While one is an international economic forum and the other is a military alliance originally conceived to prevent Soviet agression, their outcomes are linked by a lack of vigour and funding. The flaccid direction from both of these summits does not bode well for the near future of economic cooperation nor for a coordinated response to serious threats from Iran, the Taliban/Al Qaida and North Korea.

The Economics of the Long Wars

By Robert Presser on November 4, 2010

A US president comes to power promising a change in foreign policy after the previous administration is discredited by overseas wars and tensions among its allies. A recent world financial crisis, coupled with increased spending on social programs has strained government spending. Upon entering office, the new president increases US military iniiatives in the hope of bringing a swift end to the fighting. Almost two years into his mandate, the mid-term elections loom and the president is facing important losses in both the House and Senate, threatening his administration’s ability to pursue its agenda. A presidency that began with so much promise has delivered little success abroad and at home, and fears the results coming in November.

A US president comes to power promising a change in foreign policy after the previous administration is discredited by overseas wars and tensions among its allies. A recent world financial crisis, coupled with increased spending on social programs has strained government spending. Upon entering office, the new president increases US military iniiatives in the hope of bringing a swift end to the fighting. Almost two years into his mandate, the mid-term elections loom and the president is facing important losses in both the House and Senate, threatening his administration’s ability to pursue its agenda. A presidency that began with so much promise has delivered little success abroad and at home, and fears the results coming in November.

Canadian High Speed Rail: More Promise than Reality?

By Robert Presser on September 9, 2010

There are two figures readers need to keep in mind as they contemplate the possibility of boarding a 250 km/h train between Montreal and Toronto: 511 and 19. The 511 is the number of kilometers of High Speed Rail (HSR) that Brazil plans to build to link its largest cities, Sao Paulo and Rio de Janeiro via Campinas. The 19 is the number of billions of US dollars this project is likely to cost. The Brazilians deserve a great deal of credit for not hiding the truth from their population as to the cost and complexity of the project. Creating HSR in Brazil is essential to relieving pressure from Brazil’s overcrowded airports and its decaying roads, which are overwhelmed by crowded buses that fight with the truck traffic between the two massive population hubs.

There are two figures readers need to keep in mind as they contemplate the possibility of boarding a 250 km/h train between Montreal and Toronto: 511 and 19. The 511 is the number of kilometers of High Speed Rail (HSR) that Brazil plans to build to link its largest cities, Sao Paulo and Rio de Janeiro via Campinas. The 19 is the number of billions of US dollars this project is likely to cost. The Brazilians deserve a great deal of credit for not hiding the truth from their population as to the cost and complexity of the project. Creating HSR in Brazil is essential to relieving pressure from Brazil’s overcrowded airports and its decaying roads, which are overwhelmed by crowded buses that fight with the truck traffic between the two massive population hubs.

Stimulate or Decimate? A post-summit briefing note for the G20 leadership

By Robert Presser on July 22, 2010

Dear G20 leaders,

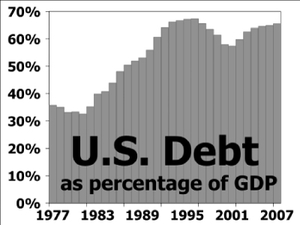

First of all, congratulations are in order for emerging with anything resembling a commitment to fiscal restraint at all, given the differing economic environments you are all facing. The message was simple and direct: cut deficits in half by 2013 and stabilize debt to GDP ratios by 2016. Boy, are you lucky that the majority of populist journalists ran to file the story before they read the fine print, because otherwise the solidarity you displayed in the group photo would look more like Swiss cheese. Japan gets an exemption from the debt level targets because they are still fighting deflation leftover from the last recession, and the US federal government is busy spending more, not less, to compensate for state budgets that are being slashed to the bone.

What do the Chinese think of the Great Recession and the Euro Crisis?

By Robert Presser on June 10, 2010

Visiting Shanghai in 2010 is the ultimate experience in Modern urban infrastructure. At the nearly-new international airport, you can take a MagLev (magnetic levitation) train that whisks you into Pudong at a top speed of 430 km/h. You then transfer to a modern subway system with 400 kilometers of track, 200 of which opened within the last year. Or, if you prefer, you can grab a cheap, new taxi from Pudong and travel into Shanghai across modern six-lane expressways and impressive new bridges that cross the river, one every few kilometers. This is the kind of town that big money, government money, buys for its citizenry when the state is wealthy and wants to show off to the world for the 2010 Shanghai Expo, the world’s fair now underway.

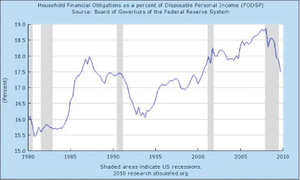

The skittish consumer: Sustaining the recovery depends on their spending – can they afford it?

By Robert Presser on April 23, 2010

After a year and a half of misery, things are looking up for the Canadian and U.S. economies. The stock markets are up over 70 per cent from their lows of March 2009, both economies put out five per cent annualized growth rates in the last quarter of 2009, and consumer spending is on a tear. In Canada, consumer spending rose at a four per cent annualized rate in Q4 2009 and in the U.S., spending was up 1.6 per cent month to month in March, including a whopping one per cent due to sales of autos and parts alone. Economists and governments are now debating the sustainability of such encouraging results as they plan monetary and fiscal policy for the year to come.

After a year and a half of misery, things are looking up for the Canadian and U.S. economies. The stock markets are up over 70 per cent from their lows of March 2009, both economies put out five per cent annualized growth rates in the last quarter of 2009, and consumer spending is on a tear. In Canada, consumer spending rose at a four per cent annualized rate in Q4 2009 and in the U.S., spending was up 1.6 per cent month to month in March, including a whopping one per cent due to sales of autos and parts alone. Economists and governments are now debating the sustainability of such encouraging results as they plan monetary and fiscal policy for the year to come.

A Conservative Budget

By Robert Presser on March 25, 2010

The game changing 1995 federal budget slashed transfers to the provinces and set in place five years of spending restraint. The resulting limited growth in federal government spending, coupled with falling interest rates that reduced the interest burden on Canada’s existing debt, allowed the federal government to move into surplus before the millennium and post a decade of surpluses which ended in 2009. The great shame of this period of fiscal nirvana is that it could have been even better for the Canadian taxpayer. The Liberals consistently under-estimated their surpluses and even after an orgy of last-minute spending in the final quarter of every fiscal year up until their defeat in 2006, they still exceeded their surplus predictions.

The game changing 1995 federal budget slashed transfers to the provinces and set in place five years of spending restraint. The resulting limited growth in federal government spending, coupled with falling interest rates that reduced the interest burden on Canada’s existing debt, allowed the federal government to move into surplus before the millennium and post a decade of surpluses which ended in 2009. The great shame of this period of fiscal nirvana is that it could have been even better for the Canadian taxpayer. The Liberals consistently under-estimated their surpluses and even after an orgy of last-minute spending in the final quarter of every fiscal year up until their defeat in 2006, they still exceeded their surplus predictions.

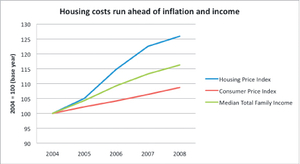

Bubble, Bubble…Canadian Debt Trouble

By Robert Presser on February 11, 2010

Canadians can rarely feel smug when comparing themselves to their US

neighbors, but when it comes to our banking sector our airs of

superiority are justified. While the Obama administration contemplates

an overhaul of financial industry regulation and punitive taxation of

banking executives’ bonuses, Prime Minister Harper announced in Davos

that Canada has no intention of “micro-managing” Canada’s banks.

Canadians can rarely feel smug when comparing themselves to their US

neighbors, but when it comes to our banking sector our airs of

superiority are justified. While the Obama administration contemplates

an overhaul of financial industry regulation and punitive taxation of

banking executives’ bonuses, Prime Minister Harper announced in Davos

that Canada has no intention of “micro-managing” Canada’s banks.

Copenhague: Une grande douleur pour peu de gain

By Robert Presser on January 7, 2010

Plutôt que d’analyser tous les détails de l’accord, l’objectif de cet article sera d’adopter une perspective à plus long terme fondée sur l’hypothèse que l’accord non-contraignant conclu à Copenhague doit être transformé en un accord contraignant et vérifiable pour la réduction des émissions à long terme. L’entente conclue entre les États-Unis, la Chine, l’Inde, le Brésil et l’Afrique du Sud contient des engagements pour que la réduction des émissions limite le réchauffement climatique à un maximum de 2 degrés Celsius, mais que veut dire cela en termes de vraies cibles ?

Plutôt que d’analyser tous les détails de l’accord, l’objectif de cet article sera d’adopter une perspective à plus long terme fondée sur l’hypothèse que l’accord non-contraignant conclu à Copenhague doit être transformé en un accord contraignant et vérifiable pour la réduction des émissions à long terme. L’entente conclue entre les États-Unis, la Chine, l’Inde, le Brésil et l’Afrique du Sud contient des engagements pour que la réduction des émissions limite le réchauffement climatique à un maximum de 2 degrés Celsius, mais que veut dire cela en termes de vraies cibles ?

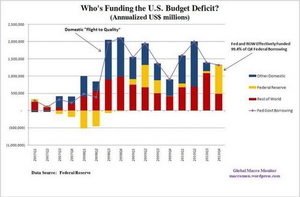

Do you know who the real bankers are?

By Robert Presser on December 3, 2009

This year has been a seesaw for the Canadian Dollar. Plunging to the 80 cent USD range during the onset of financial crisis of 2008 and retesting those lows in March of this year, our currency has recovered to trade in a relatively tight range of 92 to 97 cents US over the past two months. The recovery in our dollar has paralleled the recovery in stock markets and commodities, especially oil. Sadly, Canadians don’t look at the broader currency picture – while our Loonie is stronger against the US greenback, the USD continues to fall to ever deeper lows against a broader index of international currencies. The US is pursuing a weak dollar policy despite public statements to the contrary and Canada is along for the ride.

This year has been a seesaw for the Canadian Dollar. Plunging to the 80 cent USD range during the onset of financial crisis of 2008 and retesting those lows in March of this year, our currency has recovered to trade in a relatively tight range of 92 to 97 cents US over the past two months. The recovery in our dollar has paralleled the recovery in stock markets and commodities, especially oil. Sadly, Canadians don’t look at the broader currency picture – while our Loonie is stronger against the US greenback, the USD continues to fall to ever deeper lows against a broader index of international currencies. The US is pursuing a weak dollar policy despite public statements to the contrary and Canada is along for the ride.

Canada at the G20: power, but do we have a plan?

By Robert Presser on November 4, 2009

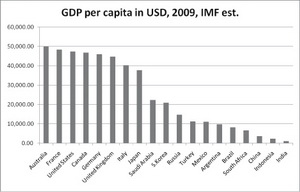

In 1976, French President Valery Giscard d’Estaing decided that it would be a good idea to invite the leaders of the major western economic powers (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States of America) to an informal summit at a chateau outside of Paris to discuss their current common economic problems, giving birth to the G7. Later expanded to include Russia (G8) this intimate grouping of world powers dominated the international economic and trade agenda until the Asian currency crisis of 1997 had ripple effects around the world, making a broader consultative forum a priority to encourage cooperation with the developing world. That body was christened the G20, and today it represents nearly 85% of worldwide economic output (GDP) though 90% of the world’s countries are not at the table.

In 1976, French President Valery Giscard d’Estaing decided that it would be a good idea to invite the leaders of the major western economic powers (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States of America) to an informal summit at a chateau outside of Paris to discuss their current common economic problems, giving birth to the G7. Later expanded to include Russia (G8) this intimate grouping of world powers dominated the international economic and trade agenda until the Asian currency crisis of 1997 had ripple effects around the world, making a broader consultative forum a priority to encourage cooperation with the developing world. That body was christened the G20, and today it represents nearly 85% of worldwide economic output (GDP) though 90% of the world’s countries are not at the table.

Are we as good as we think we are?

By Robert Presser on October 1, 2009

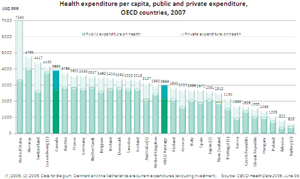

According to the latest statistical data, the Canadian recession ended

sometime over the summer and we will see slow growth in the third and

fourth quarters of 2009. While this is likely to be a jobless recovery

until sometime in 2010, Canadians believe that our conservative banking

culture coupled with greater financial market regulation spared us the

mortgage melt-down and destruction of consumer wealth that devastated

other first world economies. While that may be the case, it does not

mean that Canada is perfect on all major economic and government policy

issues. This article takes a look at some major issues facing western

economies and what international organizations like the World Bank have

to say about Canada’s success in managing them.

According to the latest statistical data, the Canadian recession ended

sometime over the summer and we will see slow growth in the third and

fourth quarters of 2009. While this is likely to be a jobless recovery

until sometime in 2010, Canadians believe that our conservative banking

culture coupled with greater financial market regulation spared us the

mortgage melt-down and destruction of consumer wealth that devastated

other first world economies. While that may be the case, it does not

mean that Canada is perfect on all major economic and government policy

issues. This article takes a look at some major issues facing western

economies and what international organizations like the World Bank have

to say about Canada’s success in managing them.

..Gerald and Louise Take a Tram Ride

By Robert Presser on September 2, 2009

Since Montreal is apparently flush with cash to undertake new infrastructure projects, a study by engineering consortium Genivar-Systra was commissioned to demonstrate the viability of a 12 kilometre tramway network for Montreal. The cost is estimated at $500-$750 million dollars, depending on the scope of secondary infrastructure work that is included in the study. But what would a trip on a Montreal tramway really look like? Imagine if we could take a ride on the Guy Street to Jean Talon line?

Statistical recovery masks suffering millions

By Robert Presser on August 6, 2009

One could be forgiven for being optimistic these days. The stock markets are up 30% from their lows of March 2009, even taking into account the recent correction; housing starts and new home purchases showed surprising strength in Canada in June; job losses in the US and Canada seem to be slowing; lower mortgage rates and gas prices have freed up cash in consumer’s pockets and allowed more people to keep their homes; auto sales seem to be bottoming out

One could be forgiven for being optimistic these days. The stock markets are up 30% from their lows of March 2009, even taking into account the recent correction; housing starts and new home purchases showed surprising strength in Canada in June; job losses in the US and Canada seem to be slowing; lower mortgage rates and gas prices have freed up cash in consumer’s pockets and allowed more people to keep their homes; auto sales seem to be bottoming out

Save Our Suburbans! How the Obama Administration is going to change what and how you drive

By Robert Presser on July 2, 2009

Visitors to Havana marvel at the American automobiles of the 1950’s that have survived five decades of revolutionary communist rule to continue to ply its streets. Some are still running due to modified Russian auto parts, while other have had their lives extended by craftsmen who lovingly reproduce each fallen piece of chrome so that the autos appear as pristine as they did on Batista’s last day in the Presidential Palace...

Visitors to Havana marvel at the American automobiles of the 1950’s that have survived five decades of revolutionary communist rule to continue to ply its streets. Some are still running due to modified Russian auto parts, while other have had their lives extended by craftsmen who lovingly reproduce each fallen piece of chrome so that the autos appear as pristine as they did on Batista’s last day in the Presidential Palace...

The Unintended Consequences of Buy American

By Robert Presser on July 2, 2009

Last October this column reviewed the possibility of a trade war between the US and Canada if Obama were to take the White House. While the exact form of the dispute was not known at the time, some form of economic nationalism was inevitable as the US rustbelt demanded payback for delivering the electoral votes required to secure a decisive victory in the Electoral College. Congress crafted a stimulus package designed to create US jobs related to infrastructure and manufacturing, and in their expedient haste to curry political favour with their constituents they created the Buy American (BA) provision that related to municipal investment projects...

Government’s misguided attempt to end the economic cycle (DATE DE PARUTION 13 NOVEMBRE 2008)

By Robert Presser on June 18, 2009

Late last week, General Motors and Ford announced a combined third quarter loss of $7.2 billion US. In other years, this would be considered catastrophic as an annual loss figure, but in the current economic context it was expected since new car purchasing in the US has fallen to a 25 year low with no sign of immediate recovery. GM has put its potential acquisition of Chrysler on hold and now all three major US automakers are appealing to the US government for $25 billion in low interest loans on top of the $25 billion handout they were previously offered for retooling their product lines...

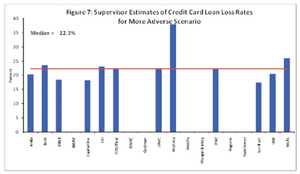

The Next Phase of the Banking Crisis

By Robert Presser on May 28, 2009

Relaxing the mark-to-market rules means we will never know what the banks are really worth

The Federal Reserve’s stress test results are in and to no one’s surprise, all the big US Bank Holding Corporations (BHCs) passed. Getting a passing grade in the stress test, more formally known as the Supervisory Capital Assessment Program (SCAP) was a lot like getting a passing grade in gym class – just because everyone gets by, this does not mean that all the subjects are equally capable and robust. The SCAP report indicates that 10 of the 19 largest US banks should collectively raise an additional $75 billion USD in tier-one capital in order to bolster their reserves to face a protracted recession. The report outlines the various types of assets held by the banks, including toxic assets like securitized mortgages, commercial loans and mortgages originated in-house, consumer loans and revolving credit card debt.

The Federal Reserve’s stress test results are in and to no one’s surprise, all the big US Bank Holding Corporations (BHCs) passed. Getting a passing grade in the stress test, more formally known as the Supervisory Capital Assessment Program (SCAP) was a lot like getting a passing grade in gym class – just because everyone gets by, this does not mean that all the subjects are equally capable and robust. The SCAP report indicates that 10 of the 19 largest US banks should collectively raise an additional $75 billion USD in tier-one capital in order to bolster their reserves to face a protracted recession. The report outlines the various types of assets held by the banks, including toxic assets like securitized mortgages, commercial loans and mortgages originated in-house, consumer loans and revolving credit card debt.

China Targets Canada!

By Robert Presser on May 6, 2009

International Trade Minister Stockwell Day has returned from a goodwill trade tour of China making all the right gestures and remarks; a commitment to fight protectionism, two new Canadian trade offices to promote our goods and services in China, and kind words for Chinese officials in an effort to improve bilateral relations. There is even talk of a visit by Prime Minister Harper at a later date, a change of heart from his failure to attend the 2008 Olympics...

International Trade Minister Stockwell Day has returned from a goodwill trade tour of China making all the right gestures and remarks; a commitment to fight protectionism, two new Canadian trade offices to promote our goods and services in China, and kind words for Chinese officials in an effort to improve bilateral relations. There is even talk of a visit by Prime Minister Harper at a later date, a change of heart from his failure to attend the 2008 Olympics...

The view from the top of Debt Mountain

By Robert Presser on April 9, 2009

After the conclusion of what is probably the most important G20 meeting ever held, one can be forgiven for feeling optimistic. While unemployment in the US is at a quarter-century high at 8.3% and first world economies continue to contract, G20 leaders looked past their local economic miseries, resulting in an remarkable level of international commitment expressed in London. This solidarity was truly exceptional given the divergent opinions held by many going into the meeting.

After the conclusion of what is probably the most important G20 meeting ever held, one can be forgiven for feeling optimistic. While unemployment in the US is at a quarter-century high at 8.3% and first world economies continue to contract, G20 leaders looked past their local economic miseries, resulting in an remarkable level of international commitment expressed in London. This solidarity was truly exceptional given the divergent opinions held by many going into the meeting.

Stressing the banks!

By Robert Presser on March 19, 2009

Investors around the world could be forgiven for expressing some optimism given the stock market results for the week ending on March 13th 2009: US markets posted the biggest gains in twenty years, with the Dow up over 9%, with similar gains on the broader S&P 500 index and the Canadian TSX. One of the catalysts for this surge of optimism was an announcement by Citigroup that after receiving $45 billion in government assistance, the bank was able to post an $8 billion dollar profit in their current fiscal quarter...

Investors around the world could be forgiven for expressing some optimism given the stock market results for the week ending on March 13th 2009: US markets posted the biggest gains in twenty years, with the Dow up over 9%, with similar gains on the broader S&P 500 index and the Canadian TSX. One of the catalysts for this surge of optimism was an announcement by Citigroup that after receiving $45 billion in government assistance, the bank was able to post an $8 billion dollar profit in their current fiscal quarter...

Surfing the Kondratieff Economic Long Wave

By Robert Presser on February 26, 2009

As the world collectively suffers the hangover of economic excesses propagated by excessive debt, greed and deregulation, many wonder if all or any of this could have been avoided. Fans of Nikolai Kondratieff will tell you that this era of falling prices, deleveraging of excessive debt and increased unemployment was both predictable and unavoidable. We are suffering through the Winter, or final season of an economic long wave that lasts from forty to sixty years, and that we can expect that it will last for years to come...

Obama’s Megatrillions for Change

By Robert Presser on February 5, 2009

Many around the world celebrated as they watched the inauguration festivities in Washington DC. Barack Obama warned Americans that the challenges they face as a nation are numerous and grave, requiring individual sacrifice and difficult choices to plot a path back to prosperity. While he spent a few minutes speaking to the world, he avoided asking them for their contribution to America’s renewal; the purchase of $5 trillion of new US debt to cover a half decade of enormous budget deficits.,,

Quebec at the crossroads: the recession as Charest’s Odyssey

By Robert Presser on January 15, 2009

Many Quebeckers remain fixated on the economic problems in the United States and their spillover effect into Canada, notably the potential bankruptcy of one or more of the Big Three US automakers and the devastation this would wreak on central Canadian manufacturing...