Lost in the news between conflicts in the Middle East, Russian meddling the in the Ukraine and racial strife in the US, The Bank of Canada announced a 1.7% core inflation rate last week. The core rate excludes certain food and energy costs; after all, who puts gas in their car and eats dinner? However, even the total CPI (Consumer Price Index) only increased at an annual rate of 2.1%. Given that this corresponds with the BofC’s target rate of 2% inflation, Canadians can expect sustained low interest rates and the Canadian dollar promptly lost half a cent against the USD. Canada is awash in cheap money, the lowest interest rates we have seen in several generations and Canadians are addicted to them. Canadian consumer debt remains a concern to policymakers in government and at the BofC, and our real estate prices enjoy high single digit price increases year over year, which would not be possible without the generous variable rate mortgages the banks continue to hand out. Should you be worried or care about mounting debts in Canada? The answer is yes, since eventually either interest rates will rise to levels that the debtors cannot afford, inflation will re-ignite to destroy the value of your savings, or perhaps both, last seen in the late 1970s.

Milton Friedman, the famous economist, coined the phrase that “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Loosely translated into non-economic terms, too much money circulating in the economy chasing too few goods and services puts upward pressure on prices, therefore leading to price inflation. An inflationary price-wage spiral results when workers start demanding salary increases to cover the cost of the goods and services they purchase, increasing production costs for providers, which results in another round of price increases. Friedman led the Monetarist school of economic thought, which advocates using money supply control from the central bank and, in turn, interest rates, to only grow the money supply enough to facilitate economic growth based on innovation, population growth etc. Too much money in the system and you get inflation.

The last inflationary spiral occurred in the 1970’s when Richard Nixon decoupled the US dollar from the Gold Standard, to which all the major international currencies were linked since the Bretton Woods conference of 1948 re-established gold as their anchor. The Vietnam War, coupled with the Great Society program under President Johnson had put tremendous strain on the US Treasury and the government moved into deficit, which put upward pressure on the money supply. This was technically violating the link between the number of US dollars in circulation and the value of gold, since $35 USD was supposed to buy one ounce of the yellow metal, and Fort Knox was supposed to hold enough gold to back the value of US currency in circulation. If there was too much US currency around, then the value of gold was supposed to rise. In 1973, Richard Nixon famously ended the coupling of the USD to gold, saying “I am now a Keynesian in economics” referring to the British economist who favored higher government spending and interventionist policies to stimulate and sustain economic growth.

What the US got instead of higher growth was something called “stagflation” which means low growth, higher unemployment and higher inflation, heavily influenced by the 1973 oil crisis when OPEC cut supply and spiked prices. No matter what the US government did, under Gerald Ford (WIN: Whip Inflation Now lapel buttons) and Carter (we have a malaise in our nation, he told Americans) nothing could re-ignite growth or tame inflation. Finally a new Federal Reserve Board Chairman, Paul Volcker, arrived and in 1979 spiked interest rates as high as 20% to break the grip of inflation on the system. The severe recession it caused also contributed to Carter’s defeat in the 1980 presidential election by Ronald Reagan, but there were many other concurrent factors. Ironically, the lower inflation rate that Reagan enjoyed early in his first term, and the lower interest rates that also resulted, allowed Reagan to run deficits as high as $200 billion per year in the early 80s (equal to about three times that amount today) as he cut taxes and rebuilt the US military at the same time.

In Canada we had the same problems as the US during that period, but we did not have the expenses of the Vietnam War. Instead, we had spendthrift Pierre Trudeau at the helm of a series of majority and minority governments which offered Canadians generous social spending and transfers to the provinces, which resulted in even more severe deficits as a percentage of GDP than those in the US. After the Clark government was defeated on an austerity budget in 1980, the renewed Trudeau Liberals with Finance Minister Marc Lalonde introduced the successful “6 and 5” program, which compelled industry to stick to wage and price increases at those levels over several years. The Canadian experiment with managing expectations worked, and Canadian inflation also abated through the 1980s.

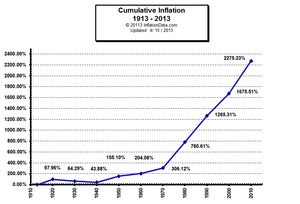

There has been a lot of debate over government manipulation of the official inflation rate, largely by changing the contents of the “basket of goods” whose prices are used to calculate inflation’s value. Consider an alternative presentation of what the US’s cumulative inflation rate was in the following graphic:

You can see that since the end of the Gold Standard era, inflation has taken off. Anyone with money in the mattress, invested in savings accounts that offered negative real interest rates, and not invested in assets that hold their value (like real estate) were real losers in this deal. Ironically, the low interest rate, free money world we live in today has resulted in even greater real asset price inflation, favoring the rich who have the money to invest in such assets, and disfavoring the poor who have few or no investible funds and spend most of their income on staples like food, for which the inflation rate is consistently underestimated.

Since the end of the Gold Standard, all paper money is known as “fiat currency” meaning that your willingness to accept a paper bill as a form of payment is based on the confidence in the government and the central bank of the issuing nation. More importantly, the continuity depends on the confidence that someone else shares your value set and will willingly accept that bill in turn when you decide to pass it on to consume another good or service. There is a subset of the investment community known as “gold bugs” who believe that the central banks’ flooding of the markets with vast amounts of liquidity will leave the world’s currencies worthless, eventually, and that the only way to protect your savings is to own gold, or other similar precious metals which have sustained value in economic crises over the centuries.

The truth is that we have been there before, and not that long ago. Hyperinflation took root in Weimar Germany when the government flooded the market with worthless currency and it took a wheelbarrow of currency to buy a loaf of bread. At the Currency Museum in Ottawa you can examine a 1 billion Deutschmark note. In the post WWII era, Greece, Italy, and others have habitually debased their currencies, wiped out liquid savings, and started the cycle all over again. Zimbabwe suffered a hyperinflation rate of 231 million percent in 2008 and famously issued a one hundred trillion dollar note!

But the intrinsic value of currencies is only one part of the equation; the other is the sensitivity to rising interest rates. Real estate agents herald sub 3% variable mortgage rates since they can keep the party going as prices in major metropolitan areas continue to rise. Consumers pile debt onto credit lines that are either unsecured at variable rates, or are tied to whatever equity they have in their homes. If rates rise even to 5% for a variable rate five-year term, how many homeowners would be unable to remain in their current abodes? No bank economist wants to talk about this possibility since their employers are the issuers of such mortgages, and the Governor of the Bank of Canada still advocates that there is consumer weakness in the system, the economy is operating below it potential, and there is no reason to raise rates.

What we have to consider is an economic shock coming from somewhere else, from which we would not be isolated given the interconnectivity of the modern world economy. A new energy crisis, sparked by a sudden drop in oil supplies (like a fundamentalist revolution in Saudi Arabia, which is not unimaginable) which would destabilize all the western economies and create a scarcity for a critical economic input, oil, resulting in rising prices and a new inflationary spiral. Interest rates would rise in turn, and the fragile real estate market upwardly spiral would quickly reverse. No, no one wants to contemplate such a scenario, but cheap money eras always end badly and we should not expect the current period’s to see a different conclusion.

We always knew we were at the end of an era when an expert commentator was confronted with historical examples and retorted with “but this time it’s different.” It’s never different, economic history is too powerful and consistent to ignore when it comes to finding the true value of the money in our pockets and in our accounts.

Comments

Please login to post comments.