An economist friend of mine remarked to me recently that she felt like she was living in the “pre” period of some kind of major world-changing event. This comment stayed with me for several weeks as I watched the Europeans struggle to bail out Greece, the Americans wrestle with deficit reduction and the debt ceiling, and the West in general fight against tyranny in Libya and Syria.

As I write this article I cannot say with any degree of optimism that any of these struggles will produce a positive outcome. The unprecedented, multi-dimensional (military, social and economic) tumult we are currently experiencing is unprecedented in modern history outside of a major world war. Our collective ability to muddle through thus far is testament to the efficacy of modern international cooperation among developed and developing nations. Those who believe that our institutions like the United Nations, the International Monetary Fund, the World Bank, the European Bank, the G20 and others are compromised and ineffectual should pause and consider what would have happened since 2008 had these institutions not provided a forum for discussion and coordinated response.

The greatest threat facing the world economy is the failure of the United States to get serious about deficit reduction and the political brinksmanship surrounding the raising of the debt ceiling. Not since the Romans debased the value of the coinage has a world reserve currency been so purposefully devalued by its issuing nation. To quote Nathan Lewis from his book, Gold, the Once and Future Money, "Roman coinage began to be debased under the rule of Nero (AD 54-68) with the content of money being reduced from 100% silver to 90% silver. The trend continued in AD 193-210 when the silver content was reduced to 50%. So in a period of 150 years a 50% debasement was put into effect."

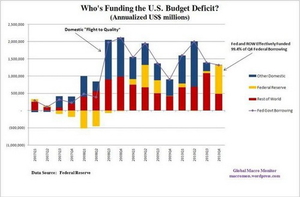

The Roman experience did not end well, with traders in the empire eventually refusing to take the currency. Today, a more subtle trend is underway, with the primary US banker, China, no longer buying significant quantities of US debt. Absent the Chinese, the US Federal Reserve has been purchasing the majority of recent debt issued by the US Treasury, as evidenced in the table below. If any other nation flooded the markets with money in this fashion they would immediately be labeled irresponsible profligates and castigated in public economic forums for printing money. Since this is the United States and the US Dollar remains the de-facto international reserve currency, other nations are issuing warnings to the US, some economists are using the more genteel term “debt monetization” to describe US behaviour, but no one dares to call the US government insolvent – yet.

The financial flippancy of the current crop of Tea Partiers in Congress is beyond comprehension. One does not seek to “make a point” by engineering a technical default on the US debt by refusing to authorize an increase in the debt ceiling. The standoff between the US Congress and the Executive could trigger a loss of confidence far larger than the moment in the fall of 2008 when Lehman Brothers was allowed to fail. The parallel to today’s situation is simple; if Lehman was not to be saved, the no bank was safe. If the US debt system is not safe, then no nation’s debt, nor its currency is safe. This is the kind of scenario that promotes notions of the price of gold hitting $5,000 USD per ounce, making gold bugs giddy at the prospect.

The Euro was once the great hope for a gradual replacement of the US Dollar as an international reserve currency. After the Irish, Portuguese and Greek bailouts, the European banking system is basically playing a shell game of “extend and pretend”, by swapping short term debt that could not be repaid for long term debt that will very likely share that same fate, just not now. The collusion between the French and German governments to spare their private banks the losses that would have resulted from a Greek default has faced muted criticism within Europe, mostly because everyone knows that the same model will have to be used for a Spanish restructuring. Those who have been brave enough to call the Greek debt repackaging a technical default are quite right, but are being ignored for now. Looking at the effective interest rate on Greek debt trading in the secondary market clearly indicates that investors expect an eventual Greek default of at least 20% of the outstanding debt. Former Federal Reserve Chairman Alan Greenspan said as much in a recent interview, though as the original architect of easy money from the Federal Reserve he has been more careful in his criticism of current monetary policy at home.

The Euro was once the great hope for a gradual replacement of the US Dollar as an international reserve currency. After the Irish, Portuguese and Greek bailouts, the European banking system is basically playing a shell game of “extend and pretend”, by swapping short term debt that could not be repaid for long term debt that will very likely share that same fate, just not now. The collusion between the French and German governments to spare their private banks the losses that would have resulted from a Greek default has faced muted criticism within Europe, mostly because everyone knows that the same model will have to be used for a Spanish restructuring. Those who have been brave enough to call the Greek debt repackaging a technical default are quite right, but are being ignored for now. Looking at the effective interest rate on Greek debt trading in the secondary market clearly indicates that investors expect an eventual Greek default of at least 20% of the outstanding debt. Former Federal Reserve Chairman Alan Greenspan said as much in a recent interview, though as the original architect of easy money from the Federal Reserve he has been more careful in his criticism of current monetary policy at home.

Having recently returned from China and spent ten days reading the China Daily, I have surmised that the Chinese plan to support the Euro and the European debt markets because they would like to use the Euro as an alternative investment vehicle to the US Dollar. To the Chinese, Europe may be sick but at least they are taking the bitter medicine of austerity and restructuring. The Chinese regard the US being in denial and avoiding the difficult and painful decisions that the Europeans have had forced upon them by being a lesser world economic bloc.

China has its own debt problems. Over the past three years, municipal governments created local investment companies that were allowed to borrow hundreds of billions of RMB to fund economic projects, many of which have failed. The federal government is now considering initiatives to take over much of that debt which will result in that debt becoming visible on the national balance sheet for the first time. The total amount outstanding is not clear, but estimates run as high as 24 trillion RMB, or approximately $3.5 trillion USD. At least China is still growing, and the world is hoping that China continues to grow at a sustainable 8-10% for years to come. If China falters, the world recovery is likely doomed and there will not be enough surplus earnings generation for the Chinese to support the Euro or any other currency or debt market.

The economic challenges discussed thus far risk being eclipsed by an unprecedented conflict with crude nuclear weapons in the Middle East or Asia. Every day that the West leaves Kaddafi in power in Libya or fails to compel Bashar Assad to cease attacking his own people in Syria, the message to Iran is that they are increasingly untouchable. When the Israeli Prime Minister says that Iranian containment is an existential question for the Jewish state, it is not empty political diatribe. The Israelis have lost faith in the United States to deal effectively with Iran and its satellite, Syria, and will eventually be compelled to act to derail the Iranian nuclear effort. The Iranians would certainly attempt to respond with a “dirty bomb” that would spread radiation rather than produce a typical nuclear explosion. The effect on the region and the world economy is too long to speculate on in this article, but suffice to say we would all look back longingly on the banking crisis and the quaint Iran-Iraq war of the 1980s.

The instability of Pakistan is another potential flashpoint, with the possibility of Pakistani nuclear weapons falling into the hands of rebel forces or worse, Al-Qaida. The current ineffectual Pakistani regime makes me sentimental for the decisiveness of Pervez Musharraf, who spoke recently at the Montreal Conference. While not a perfect leader, he stands a much better chance of encouraging the Pakistani military to enforce Pakistani sovereignty in the Pashtun territory where Al-Qaida roams free and secure its nuclear arsenal from subversive forces. The danger is that the next Pakistani presidential elections are years away, and that India will not stand by and watch its neighbor descend into civil war. India and Pakistan have been at war before; but Pakistan has never had to face an internal insurgency at the same time that would seek to exploit the war to gain access to the most destructive cache of weapons available.

So we are on the edge of something; or perhaps on multiple edges in a political and economic collage where all the potential crises are intertwined. If we have learned anything from the 2008 banking crisis it is that bailing out everyone, deserving or not, is still cheaper than letting even one player fail and the markets losing confidence in the rest. I am concerned that our balancing act so far on the economic front has distracted and weakened the international community when it comes to critical peace and security issues. Our international institutions and skilled diplomats, and even military experts, may not have the time or resources to address the Iranian and Pakistani problems before they have escalated beyond control.