Partygoers are familiar with the ritual at the end of a festive evening – the band announces the last song, those still up for a dance take to the floor, other revellers observe, have a last drink or finish up their conversations. When the music’s over, the band thanks everyone for coming out, the lights go up and then the staffers encourage everyone to head to the door. At least this is how it is supposed to be.

This is not the case if the party is being thrown by the debt-laden developed economies of the world, and especially those within the European Economic Community who are members of the Eurozone. Imagine that the EEC is throwing a party and the European Central Bank (ECB) is the evening’s entertainment, facilitating the increasing levels of debt for both sovereign states and their banks that are partying with their bondholders, selling them debt that is unlikely to ever be repaid. The proverbial last dance should have been called in 2008, but instead the ECB found ways to keep the party going, bandaging over the bad loans by providing liquidity to member countries’ banks so that they could keep functioning. Eventually the bond market busts into the EEC’s dance hall and calls the partiers to order, forcing higher interest rates on their bond auctions to get them to stop the madness. Rather than quit the party, the revellers call for their favourite song, called “Eurobonds” to be played in its extended version by the bandleader, Germany. Germany says that the band has played long enough, and plays another tune, called “Austerity” and tries to teach the lyrics to the guests. As of this writing, the party continues with efforts underway to usurp the power of the Bandleader, Germany, or get it to literally change its tune. Who’s going to call the cops and break this one up?

The Euro may not survive in its current form, or with its current members, but that does not mean that there is a stronger alternative to the grand experiment of European monetary union. The US Dollar is another fiat currency, a pure confidence game supported by the fact that too many creditors hold far too much US debt that not one of them is willing to pull the plug on the currency. The Chinese Yuan briefly held some promise, but its lack of convertibility hinders its credibility and the Chinese have yet to come to grip with their own multi-trillion dollar debacle of bad development loans to local governments. Strong currencies like the Swiss Franc or even the Canadian Dollar do not have important enough circulation to become a safe haven or even a vehicle for substantial international exchanges like the trade in oil and other commodities. The world is stuck with a set of crippled, compromised currencies issued by countries with unsustainable debt levels. In a rational economic model, no sane investor would continue to contract for the debt offered by these nations or groups of nations, yet economic actors, including central banks like the Federal Reserve, the ECB and the Central Bank of China continue to support the system. The world needs to find a way out, and below are two modest proposals that may or may not merit consideration.

The weaker members of the Eurozone are correct when they call for the issuance of Eurobonds, but wrong when they insist that they be backed by the European Central Bank, a convenient code-name for Germany. What these nations need are “Eureverbonds” a term invented here for asset-backed bonds that have a 100 year maturity, practically forever in terms of investment horizon. In this model, debtor nations would exchange their current bonds in the market for these instruments which would pay a relatively risk-free rate of, say, 3%, but would be backed by a pledge of specific national assets that could be seized by the bondholders in case of non-payment.

As a practical example, let’s say that Italy wishes to exchange 50 billion Euros of market debt for the equivalent in Eureverbonds. The national government would have to pledge a state asset, say, the national railway system, as collateral specifically allotted as security for that tranche of debt. The valuation would be verified by an international body of economists and senior bureaucrats who would certify the worth of the pledged assets. The new debt would count as top-quality tier one capital for the investors (banks, insurance companies, and other financial institutions) holding the debt, which would allow them to leverage off their capital base to lend in the marketplace. This is a far better solution than having the banks continue the write-offs of southern European debtor nations, which would then have to be papered-over by fresh loans from the ECB, or one of the European rescue funds (EFSF, EFSM) that were created. The 100 billion Euro bailout recently arranged for the Spanish banks did not go so well; should anyone imagine that a far larger bailout of, say, the Italian banking system would work better? Eureverbonds may compromise the sovereignty of the nations pledging national assets, but one can argue that racking up so much debt to fund current consumption and generous social programs was in itself a willful compromise of national sovereignty. It all depends on how you frame the problem and the solution.

As a practical example, let’s say that Italy wishes to exchange 50 billion Euros of market debt for the equivalent in Eureverbonds. The national government would have to pledge a state asset, say, the national railway system, as collateral specifically allotted as security for that tranche of debt. The valuation would be verified by an international body of economists and senior bureaucrats who would certify the worth of the pledged assets. The new debt would count as top-quality tier one capital for the investors (banks, insurance companies, and other financial institutions) holding the debt, which would allow them to leverage off their capital base to lend in the marketplace. This is a far better solution than having the banks continue the write-offs of southern European debtor nations, which would then have to be papered-over by fresh loans from the ECB, or one of the European rescue funds (EFSF, EFSM) that were created. The 100 billion Euro bailout recently arranged for the Spanish banks did not go so well; should anyone imagine that a far larger bailout of, say, the Italian banking system would work better? Eureverbonds may compromise the sovereignty of the nations pledging national assets, but one can argue that racking up so much debt to fund current consumption and generous social programs was in itself a willful compromise of national sovereignty. It all depends on how you frame the problem and the solution.

The Eureverbonds would be tradable in the marketplace after a minimum holding period of perhaps, five years for the initial investor. The value of the bonds could increase or decrease based on the prevailing risk-free interest rate in the marketplace or depending on the value of the underlying asset itself. The national governments would have the option of calling the debt if their fiscal situations improved over time. A nation like Italy certainly has enough national assets to pledge in order to cover its entire debt; it would then be free of the dreadful uncertainty of the weekly bond market auctions and the bleeding interest rate of 7% that seems to be the tipping point for a bailout. Locking in a nation’s debt at 3% is a tempting deal provided that the governments who seek recourse to this financing option resolve never to repeat the profligate errors of their past. We can all dream, can’t we?

The second proposal involves the admission that trillions of dollars in worldwide government debt are completely worthless and will never be repaid. For example, the $2 trillion dollars of debt that the US Treasury has issued to the US Federal Reserve is essentially printed money that should never have existed, since there was no private investor in the marketplace willing to contract for that debt. Not even the Chinese could stomach buying that much additional US debt, even if they had the liquidity to do so.

Once the Chinese admit to their own failed program of development loans to state and local governments, the total of that debt is also going to be in the range of $2-3 trillion dollars. These are largely infrastructure development loans that were made by Chinese banks to development companies created outside of the local and provincial governments where the work took place, since the governments could not contract for the debt themselves. Eventually the Chinese Central Bank will have to take over all these loans since the banks could not afford to write them off; the banking system would simply collapse due to a lack of capital. So the Chinese have their own stash of worthless debt that will never be repaid, though few in the West pay attention to this fact.

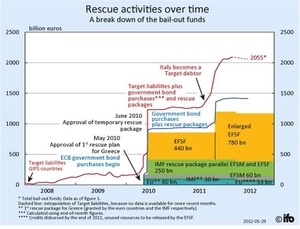

In Europe, by the time the ECB bails out all the sick countries and banks (many are inseparable) they too will be sitting on a debt worth about $2 trillion. The estimated total cost of rescuing Europe is reflected in the graphic below.

So here we have the three major world financial powerhouses, the US, Eurozone and China, all sitting on about the same amount of worthless debt. The solution would be to admit it, simply write it all off in one coordinated swoop of a pen, tell the world that they collectively made a mess and commit to never do it again. No private debt holder takes a hit because all of the debt is held by national institutions or central banks that printed money. If a government institution or its willing agent can create money out of thin air, then it can certainly write it off the same way.

Yes, there will be some initial shock and turbulence in the market on the day that this occurs. However, the announcement would be twinned with an international commitment to re-write the rules of sovereign debt and international finance to prevent nation-states from repeating these grave errors in judgement and policy. It would not be the old Gold Standard, but rather a new international compact reflecting the more sophisticated finance and debt markets that exist today. Think of it as a Bretton Woods conference for the 21st century and beyond. A key element of the compact that would emerge from this agreement is a serious spending constraint imposed on governments, forcing them to live within their means. It would also involve limiting the role of the state to avoid unfunded mandates. and curtail programs that create unfunded liabilities going forward. A good example of an unfunded liability that few are paying attention to is the US federal employee pension deficit, currently estimated at $675 billion dollars. These figures are not added to the US debt, because no funds have been disbursed, yet the liability continues to grow. Governments will have to live by simple rules; if you can’t pay for it today or in the future, don’t commit to it. Taxpayers and future generations need to be protected from the profligacy of government’s “spend today, pay indefinitely” mentality.

No conventional economist is going to like either of these ideas. The fact is that classical economists and financiers have failed miserably and the patchwork of financial band-aids now being doled out in conferences across Europe and elsewhere are likely to fail. It is time to step away from incremental, staid gestures and embrace a transformational solution, two candidates of which were modestly presented here.

Comments

Please login to post comments.