The game changing 1995 federal budget slashed transfers to the provinces and set in place five years of spending restraint. The resulting limited growth in federal government spending, coupled with falling interest rates that reduced the interest burden on Canada’s existing debt, allowed the federal government to move into surplus before the millennium and post a decade of surpluses which ended in 2009. The great shame of this period of fiscal nirvana is that it could have been even better for the Canadian taxpayer. The Liberals consistently under-estimated their surpluses and even after an orgy of last-minute spending in the final quarter of every fiscal year up until their defeat in 2006, they still exceeded their surplus predictions. Had they not engaged in haphazard last minute spending, either our debt could have been another $75 billion lower than it is today, or Canadian tax rates could have been substantially reduced. After 2000, the Liberals returned to their spendthrift ways and government spending ballooned at rates far exceeding the inflation rate. Forget the sponsorship scandal – that was small potatoes at the final number of some$50 million – the $4 billion wasted by the Liberals at Human Resources and Development Canada (HRDC) in 2003-4 was far worse, but it was a minor scandal that passed with little damage because the medial decided that the problem was too complicated for the public to understand.

Conservatives supporters figured that once they returned to power, fiscal prudence would be restored. However, the realities of pleasing a minority parliament have resulted in spending growth continuing to exceed the inflation rate. The new government left existing obligations intact and increased defense, infrastructure and foreign aid spending while keeping campaign commitments to reduce taxes like the GST. Lower surpluses were the result, but the government continued to pay down the federal debt as revenues were bolstered by strong economic growth and handsome royalties from the oilpatch.

Conservatives supporters figured that once they returned to power, fiscal prudence would be restored. However, the realities of pleasing a minority parliament have resulted in spending growth continuing to exceed the inflation rate. The new government left existing obligations intact and increased defense, infrastructure and foreign aid spending while keeping campaign commitments to reduce taxes like the GST. Lower surpluses were the result, but the government continued to pay down the federal debt as revenues were bolstered by strong economic growth and handsome royalties from the oilpatch.

Small-c conservatives grumbled that the government was not really behaving in a fashion consistent with conservative thought, but held their discontent, recognizing that their grasp on power was tenuous and at least government income exceeded expenditures. Following the onset of the Great Recession at the end of 2008, the virtuous cycle of strong economic growth coupled with rising receipts from oil royalties came to a sudden halt. Not only did general tax receipts plummet, but oil fell to $40 per barrel and the royalties collapsed in lockstep. On top of the revenue implosion, domestic and international pressure forced the Conservatives to commit to a 2-year, $56 billion dollar stimulus package that they were very reticent to introduce. The result was an anathema to doctrinaire conservative thought; a projected $53 billion deficit for fiscal year 2009-10, and deficits well into the future as long as no drastic change in policy was undertaken.

With this budget, the Conservatives have truly returned to their intellectual fold. Calling for a general review of all departmental expenditures coupled with salary restraint for the public service will please the Conservative’s electoral base while signaling the financial markets that the special spending created by the recession will come to an end in the current fiscal year. The pledge not to increase taxes is a powerful intellectual and electoral promise that is consistent with their base of support and makes it extremely difficult for the Liberals to propose tax increases in any future election campaign.

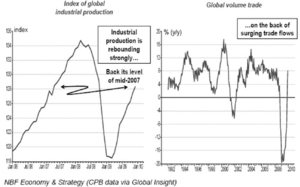

When it comes to under-promising and over-delivering, the Conservatives have learned a few lessons from the Liberals’ experience throughout the 1990s. The Liberals would practice restraint in their economic growth predictions and consistently post higher revenues as a result – the Conservatives are poised to use the same strategy to bring the budget back into surplus more quickly than their prediction of fiscal year 2014-15. The chart from National Bank Financial exhibits the stunning economic growth posted by Canada in the last quarter of 2009 – and chances are that 2010 growth will exceed the Conference Board of Canada prediction of 3.3%. Therefore, once the remaining $19 billion of stimulus spending is over with, the deficit will shrink more rapidly than predicted due to surprising revenue improvements linked to higher growth rates.

One quarter of stellar economic growth goes not guarantee a trend – and there are significant risks that could derail the growth scenario. The first is that the United States, our primary trading partner, may face a double-dip recession and the impact of that contraction would certainly be felt in Canada. The Canadian dollar could exceed par with the USD and remain elevated for an extended period of time, resulting in job losses in Canadian manufacturing and increased unemployment insurance expenses.

On the contrary, revised growth in world trade, continued raw materials consumption in developing economies like China and India bode well for Canada’s resource sector. Canada needs the world economy to post consistent improvement and push demand upward for Canada’s raw materials, but not to the point of overheating so that materials pricing rises to the point that it stifles demand. In short, Canada needs the “goldilocks” scenario in international trade – a stable dollar, moderately rising prices and consistent, sustainable growth among its trading partners.

Chances are that Canada is going to get its dream scenario. China and India are going to power Asian growth, conservative governments are taking over in Latin and South America where we have made efforts over the past decade to expand trade relationships, and a Republican-dominated Congress come the 2010 mid-term elections may restore US fiscal sanity and avoid a further decay in the US dollar and address their own ballooning federal deficit.

This budget does a lot to show Canadians the way back to the surpluses that they once came to expect, though they did not get to enjoy the substantial income tax reductions that could have resulted had their Ottawa politicians resisted the urge to goose spending along the way. The most important result of this budget is that is re-syncs the Ottawa mandarins with the Canadian mindset of fiscal prudence, in stark contrast to the realities being lived by our G8 partners. No future Canadian government can table budgets with significant deficits and take the attitude that they don’t matter. Canadians have already lived through, and rejected, that era and demand long-term responsibility from their elected representatives.